Everything You Need to Know About Special Occupational Taxpayer (SOT)

Posted by Mandu Moses on Dec 8th 2023

In the complex web of taxation regulations, the Special Occupational Taxpayer (SOT) designation stands out. It gives unique rights and responsibilities to certain individuals and entities, setting them apart in the world of taxation.

Image Courtesy: gear-report.com

In recent years, SOTs have become a focal point of tax policy discussions, due to their unique implications and specialized obligations. This select group of taxpayers, operating within specific sectors or engaged in particular activities, is subject to a distinct set of rules and privileges.

This article aims to be a comprehensive guide to everything you need to know about Special Occupational Taxpayers. We will provide clarity on its definition, shed light on its historical evolution, and navigate the world of its classifications and implications.

At its core, SOT is a unique status that transcends conventional tax brackets. To comprehend its intricacies, we will explore the different types of SOTs, the eligibility criteria for obtaining this status, and the accompanying rights and responsibilities.

Background and History of Special Occupational Taxpayer (SOT)

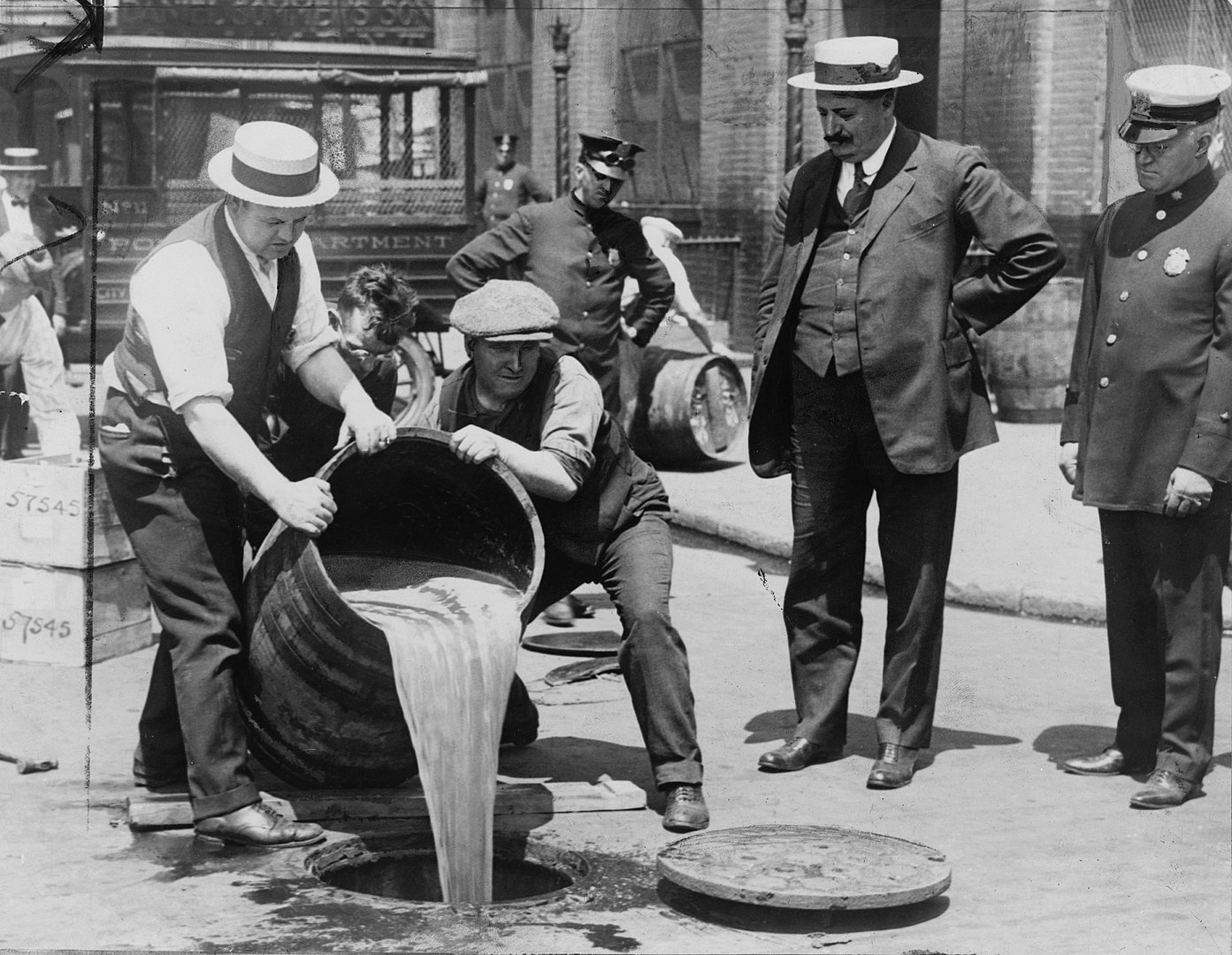

The Special Occupational Taxpayer (SOT) framework was introduced in 1934 through the National Firearms Act (NFA) to regulate and tax certain activities related to firearms and alcohol, particularly to curb illegal manufacturing and distribution of illicit alcohol and unlawful possession of firearms during the Prohibition era.

The Prohibition Era

Photo Courtesy: United States Library of Congress, Prints and Photographs division

During Prohibition, the illegal production and distribution of alcoholic beverages spread, leading to widespread criminal enterprises. The government sought effective means to control these activities and generate revenue in the process. The NFA, which introduced the SOT framework, was part of a comprehensive strategy to regulate and tax specific occupations associated with these illicit practices.

National Firearms Act (1934)

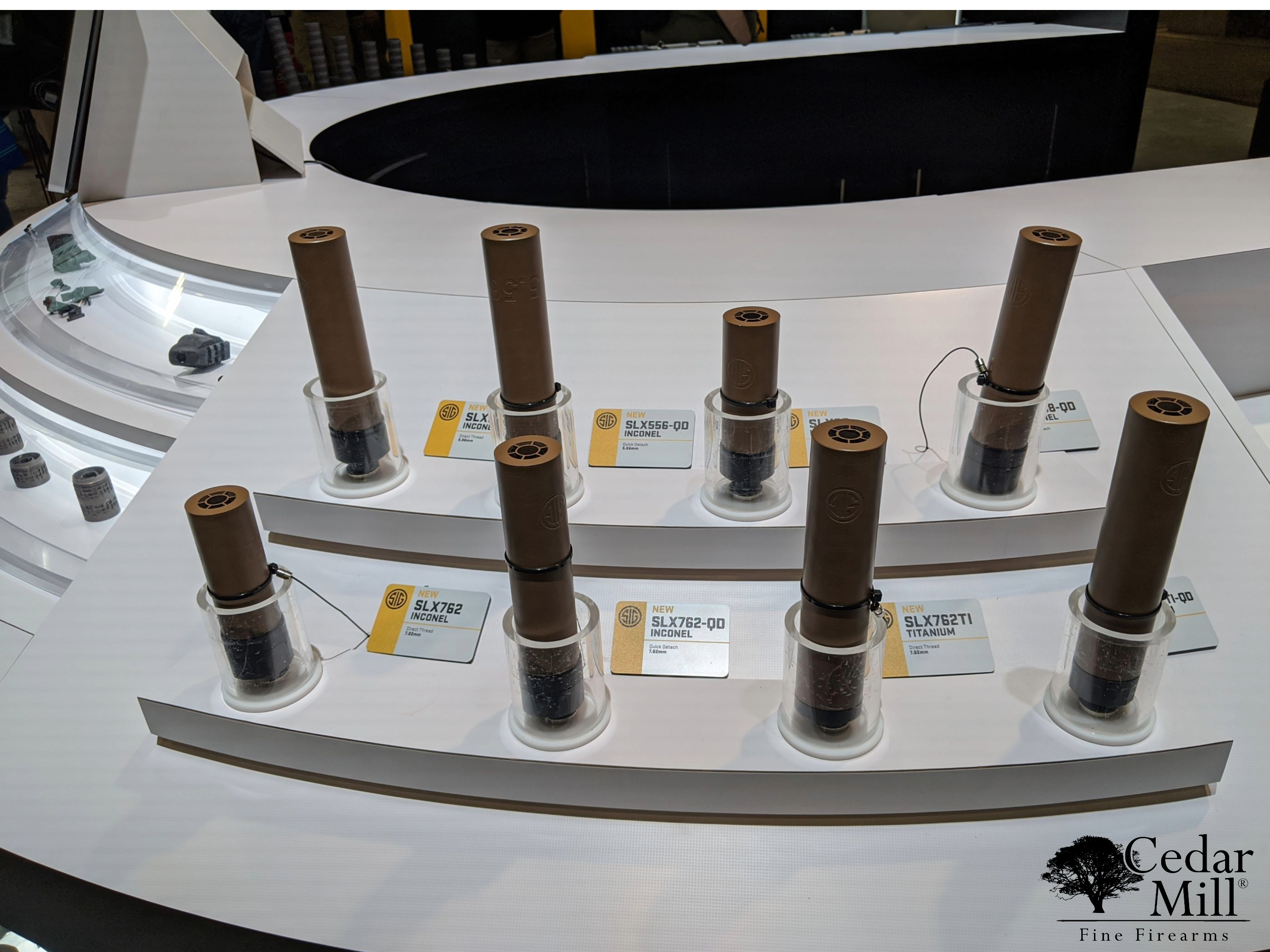

The NFA of 1934 was enacted to address the escalating violence associated with organized crime during Prohibition. This Act imposed strict regulations on the ownership, transfer, and possession of certain firearms, including machine guns, short-barreled rifles, and suppressors. The SOT provisions within the NFA mandated that individuals engaging in specified firearm-related activities register and pay an annual tax.

Evolution and Amendments

The regulatory landscape surrounding SOT has undergone significant changes through legislative amendments over the years. One notable amendment occurred with the passage of the Gun Control Act of 1968, which expanded the scope of regulated firearms and refined the SOT framework. Subsequent amendments, such as those in 1986, introduced additional restrictions and requirements for SOT taxpayers.

Contemporary Relevance

While SOT originated as a response to the unique challenges of the Prohibition era, its relevance has persisted into the modern era. SOT continues to play a crucial role in regulating and taxing specific occupational activities today, ensuring compliance with federal laws related to firearms, alcohol, and other controlled substances.

Application Process for Special Occupational Taxpayer (SOT)

To be eligible for Special Occupational Taxpayer (SOT) status you must be engaged in a business or profession that involves the manufacturing, distribution, or sale of regulated goods, such as firearms, ammunition, alcohol, or explosives. Common categories of eligibility include:

- firearm dealers and manufacturers

- alcohol producers and distributors

- tobacco manufacturers and importers

- explosive manufacturers and dealers

Eligibility requirements may vary depending on the specific SOT category and the laws of your state and locality. Be sure to research the specific requirements for the SOT category you are interested in before applying.

Application Process

i. To apply for SOT status, you must follow the steps below:

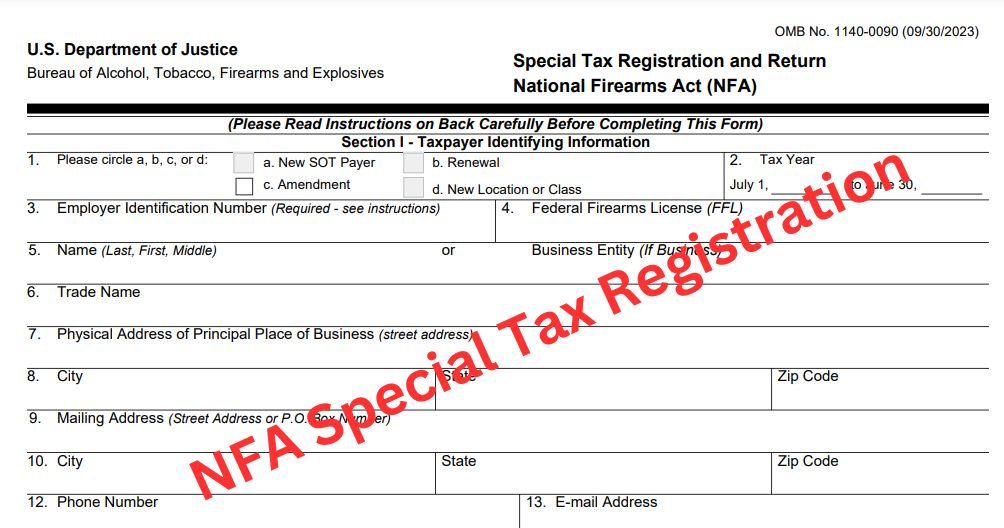

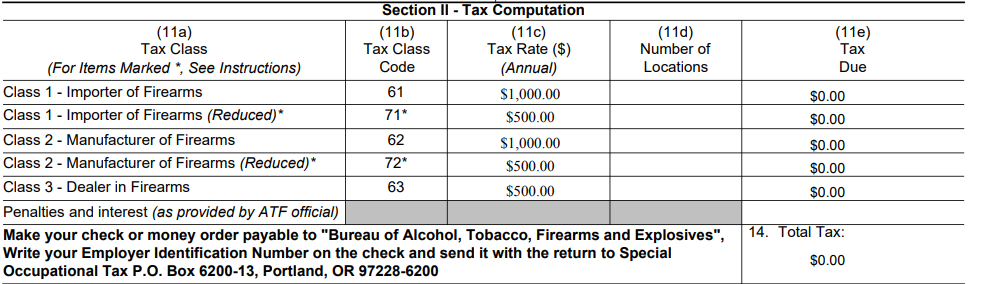

i. Complete the ATF Form 5630.7

This form is available on the ATF website. Be sure to complete the form accurately and completely while providing the required information. This will include your business details, contact information, and the specific SOT category you are applying for.

ii. Submit Supporting Documentation

You may also need to submit supporting documentation with your application. This may include business licenses, proof of compliance with zoning regulations, and any other documents specified in the application form.

iii. Pay Application Fees

There is a non-refundable application fee for all SOT applications. The fee amount varies depending on the SOT category.

iv. Submit Your Application

Once you have completed the application form and gathered all required documentation, submit it to the ATF. You can submit your application by mail, fax, or electronically.

v. Wait for Approval

The ATF will review your application and determine whether to approve it. This process may take several weeks or months, depending on the complexity of your application and the workload of the ATF.

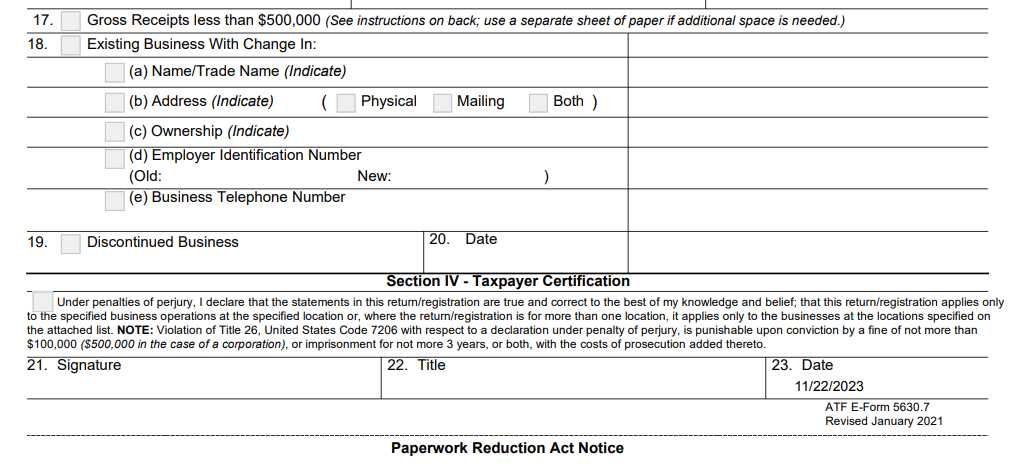

vi. Receive Your SOT Certificate

If your application is approved, you will receive a Special Occupational Taxpayer certificate. This certificate serves as official documentation of your SOT status.

Ongoing Compliance

It is important to maintain ongoing compliance with all relevant laws and regulations in order to maintain your SOT status. This includes paying your SOT tax on time and meeting all safety and security requirements.

Tips for a Smooth Application Process

To ensure a smooth and successful application process, be sure to:

- Research the specific guidelines provided by the ATF for the SOT category you are applying for.

- Complete the application form accurately and completely, and provide all required information.

- Gather all required supporting documentation.

- Pay your application fee on time.

- Submit your application early.

If you have any questions or concerns about the SOT application process, please contact the ATF.

Rights and Privileges of Special Occupational Taxpayers (SOT)

Special Occupational Taxpayers (SOT) enjoy unique rights and privileges that distinguish them from other taxpayers. These privileges are granted to individuals or entities holding specific SOT classifications and play a vital role in various industries.

Rights and Privileges

Exemptions and Advantages

SOT holders may be exempt from certain taxes or enjoy reduced rates, depending on their SOT classification. For example, a SOT in the firearms industry may benefit from exemptions related to the transfer tax on certain types of weapons.

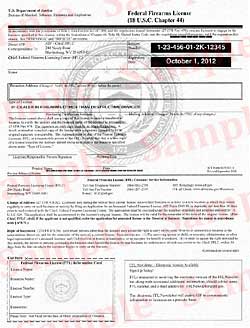

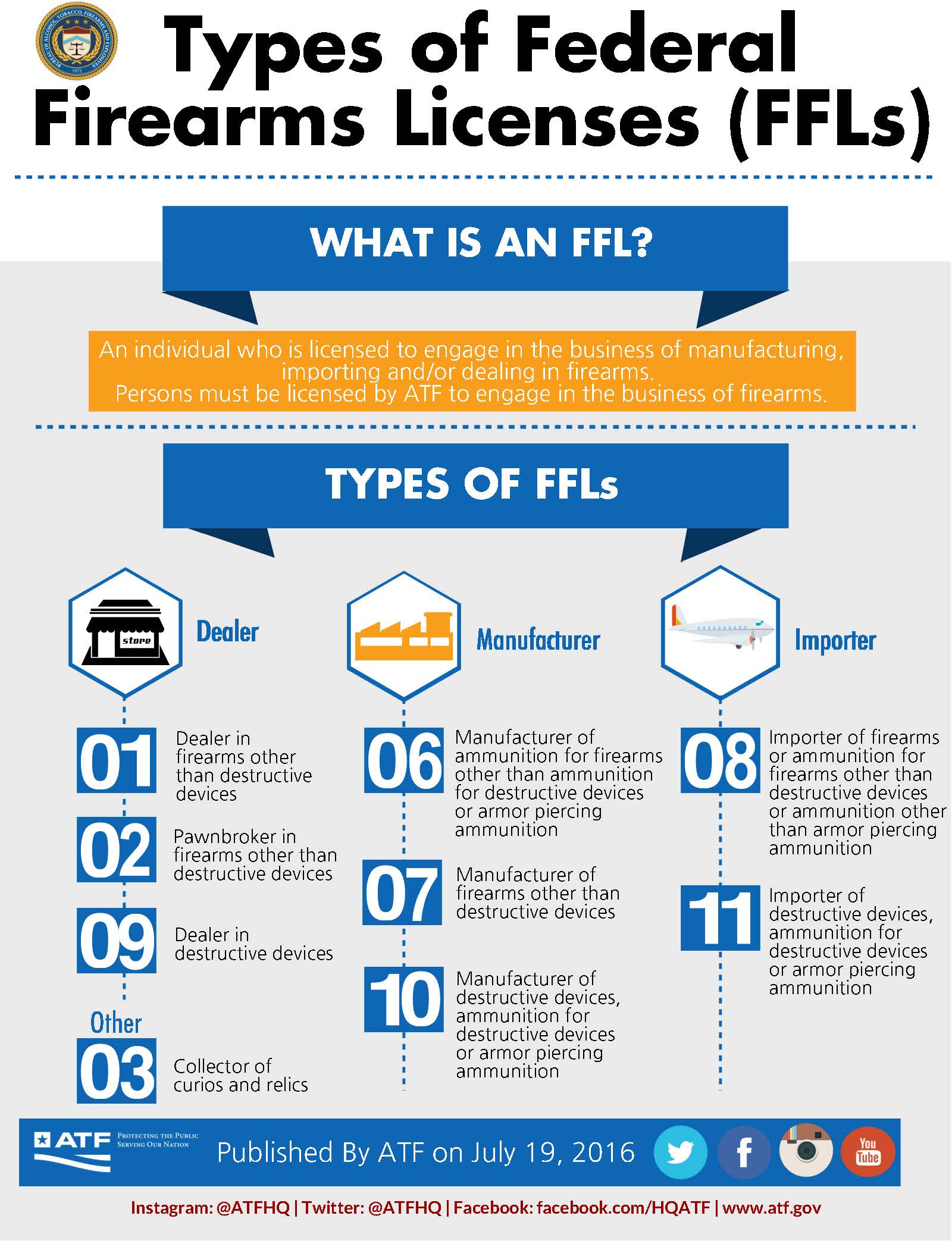

Specialized Licenses

SOT holders often gain access to specialized licenses that are essential for engaging in specific business activities. Examples would be manufacturing, distributing, or dealing in certain controlled items. A SOT in the alcohol, tobacco, and firearms industry might be granted a Federal Firearms License (FFL) allowing them to engage in the business of manufacturing or dealing in firearms.

Regulatory Advantages

SOT status can provide regulatory advantages, streamlining certain processes for businesses. This might involve expedited approvals for certain transactions or reduced paperwork requirements. These regulatory advantages contribute to a more efficient and effective operation for SOT holders.

Limitations and Restrictions

Stringent Compliance Requirements

SOT holders must adhere to specific rules and regulations governing their industry, and non-compliance can lead to serious consequences. This includes maintaining accurate records, submitting timely reports, and ensuring compliance with all relevant laws.

Restricted Activities

Certain SOT classifications may come with restrictions on the types of activities a taxpayer can engage in. A SOT in the alcohol industry may have limitations on the hours of operation or the types of products they can sell. Understanding and abiding by these restrictions is crucial to maintaining SOT status and avoiding legal complications.

Ongoing Obligations

SOT holders must actively fulfill ongoing obligations, including timely renewal of their SOT status. Failure to meet these obligations can result in the loss of SOT privileges and, in some cases, legal repercussions.

Special Occupational Taxpayer status offers valuable rights and privileges, but it is crucial for individuals and entities to be aware of the associated limitations and restrictions. By navigating these aspects thoughtfully, SOT holders can optimize the benefits of their tax status while ensuring compliance with applicable laws and regulations.

Compliance and Renewal for Special Occupational Taxpayer (SOT)

Compliance and renewal are integral aspects of maintaining Special Occupational Taxpayer (SOT) status. SOT holders bear ongoing obligations and responsibilities, and understanding the renewal process is crucial to ensuring continued compliance.

Compliance Requirements

SOT holders must adhere to various compliance requirements to maintain their status. These obligations are in place to regulate and oversee activities that fall under the purview of SOT. Key compliance requirements include:

Record-keeping

SOT holders must maintain accurate and up-to-date records of their activities to provide transparency and accountability. These records may be used to demonstrate compliance with regulations, track business operations, and facilitate audits.

Reporting

Periodic reporting requirements vary depending on the specific SOT classification held. However, all SOT holders are expected to submit reports that detail their activities, such as transactions, acquisitions, and manufacturing processes. These reports help regulatory authorities monitor SOT activities and identify potential compliance risks.

Regulatory adherence

SOT holders must strictly adhere to all federal and state regulations governing their specific SOT classification. This may include regulations related to firearm manufacturing, alcohol distribution, or explosives handling. Non-compliance with regulations can result in penalties, including the revocation of SOT status.

Tax payments

SOT holders are required to pay taxes associated with their specific SOT classification. These taxes may be levied on manufactured products, sold products, or transferred products. Timely payment of taxes is essential to maintaining compliance and avoiding penalties.

Background checks

SOT holders are subject to background checks in some cases to ensure ongoing eligibility and compliance with legal requirements. For example, SOT holders who manufacture or deal in firearms must undergo background checks to ensure they are not prohibited from possessing firearms.

Renewal Process

The SOT renewal process is designed to ensure that SOT holders remain in compliance with all applicable regulations and to facilitate the continued engagement of SOT holders in their respective activities. The renewal process typically involves the following steps:

Application Submission

SOT holders seeking renewal must submit a renewal application within a specified timeframe before the expiration of their current SOT status. The application may require updated information on the holder's activities, any changes in business structure, and compliance status.

Review and verification

Regulatory authorities review the renewal application to verify compliance with ongoing requirements. This may involve a thorough examination of records, reports, and adherence to regulations.

Fee Payment

Renewal often comes with associated fees. SOT holders must ensure timely payment of renewal fees to complete the process successfully.

Updated Information

Any changes in business operations, ownership, or other relevant details must be accurately reflected in the renewal application. This ensures that the regulatory authorities have the most current information.

Notification of Changes

SOT holders should promptly notify regulatory authorities of any significant changes during the renewal period. This transparency is crucial to maintaining compliance.

Understanding and fulfilling compliance requirements and the renewal process is essential for SOT holders to operate legally and smoothly within the regulatory framework. It ensures a continued partnership between the government and SOT holders while upholding the integrity of the system.

Importance Of Compliance and Renewal for SOTs:

Compliance and renewal are essential for SOTs to maintain their status and operate legally. By adhering to compliance requirements, SOTs demonstrate their commitment to responsible business practices and public safety. The renewal process helps to ensure that SOTs continue to meet regulatory standards and remain eligible to engage in their respective activities.

Challenges and Controversies Associated with Special Occupational Taxpayer (SOT)

Challenges

Special Occupational Taxpayer (SOT) plays a crucial role in various industries, but it is not without its challenges and controversies. Understanding these issues is essential for individuals and businesses navigating the complexities of SOT.

Complex Regulatory Landscape

SOT is subject to a complex regulatory environment, with different classifications and requirements. Navigating through these intricacies can be challenging for individuals and businesses alike, often leading to unintentional non-compliance.

For example, SOTs are classified into different types, depending on the industry in which they operate. Each type has its own set of requirements, which can be complex and confusing. Additionally, SOT regulations are constantly changing, making it difficult for taxpayers to stay up-to-date.

High Compliance Costs

The cost of compliance with SOT regulations can be substantial. Businesses may need to invest in specialized staff, training programs, and resources to ensure they meet the requirements. This financial burden can be particularly challenging for small enterprises.

For example, SOTs are required to maintain detailed records of their transactions and submit regular reports to the government. This can be a time-consuming and expensive process, especially for businesses with limited resources.

Limited Awareness

A significant challenge is the limited awareness among potential taxpayers about the nuances of SOT. Many individuals or businesses might not be aware of their eligibility or obligations, leading to inadvertent violations and legal consequences.

For example, some individuals who operate small businesses may not be aware that they are required to register as SOTs. This can lead to significant penalties if they are caught non-compliant.

Enforcement and Penalties

Enforcement of SOT regulations can be strict, and penalties for non-compliance can be severe. Navigating these consequences, both financially and legally, poses a constant challenge for taxpayers, who must stay vigilant to avoid unintentional violations.

For example, SOTs who fail to comply with regulations may be subject to fines, imprisonment, or both. In some cases, SOTs may also be barred from doing business.

Recent Developments

To address some of these challenges and controversies, there have been notable recent developments concerning the Special Occupational Taxpayer.

Legislative Updates

There have been recent legislative updates aimed at simplifying and clarifying SOT regulations. These changes may include adjustments to eligibility criteria, fee structures, or reporting requirements. Staying informed about these updates is crucial for taxpayers to ensure compliance.

For example, some recent legislative changes have expanded the eligibility criteria for certain types of SOTs. This has made it easier for businesses to qualify for SOT status and avoid unnecessary regulatory burdens.

Technological Innovations

The integration of technological solutions has streamlined certain aspects of SOT compliance. Online platforms and electronic filing systems have made it easier for taxpayers to submit required documentation and payments, potentially reducing the administrative burden.

For example, many government agencies now offer online platforms where SOTs can register, file reports, and pay taxes. This has made it easier and more efficient for taxpayers to comply with their obligations.

Increased Outreach and Education

Recognizing the issue of limited awareness, there has been a push for increased outreach and education programs. Government agencies and industry associations are working to disseminate information about SOT requirements to ensure that taxpayers are well-informed.

For example, the IRS offers a variety of educational resources for SOTs, including online guides, webinars, and workshops. These resources can help taxpayers understand their obligations and avoid unintentional non-compliance.

Potential for Policy Re-evaluation

Some controversies surrounding SOT have sparked discussions about potential policy reevaluation. Policymakers may be considering adjustments to address specific challenges or concerns raised by taxpayers and industry stakeholders.

For example, some groups have argued that the SOT requirements are too burdensome for small businesses. Policymakers may be considering ways to reduce this burden, while still ensuring that SOTs comply with important safety and security regulations.

While challenges and controversies persist in the realm of Special Occupational Taxpayer, recent developments demonstrate a commitment to addressing these issues. It is imperative for taxpayers to stay abreast of legislative changes, leverage technological advancements, and actively participate in educational initiatives to navigate the evolving landscape of SOT effectively.

Case Studies or Examples

Special Occupational Taxpayer (SOT) status is essential for businesses and individuals dealing in regulated goods and services. While the SOT process can be complex, its benefits are significant, enabling businesses to operate lawfully and ensuring compliance with federal laws.

Here are five case studies that highlight the real-world applications of SOT:

Firearm Dealerships

Firearm dealerships must obtain an SOT to sell National Firearms Act (NFA) items, such as silencers and fully automatic firearms. SOT authorization is necessary for these regulated items, ensuring compliance with federal laws.

Case Study

- Entity: John Smith Firearms, Inc.

- SOT Type: Class 3 Dealer

- SOT Activities: Sale of NFA items, such as silencers and fully automatic firearms

Benefits

- John Smith Firearms, Inc. is authorized to sell NFA items legally, which would otherwise be prohibited.

- SOT status demonstrates compliance with federal firearms laws and regulations.

- John Smith Firearms, Inc. can attract new customers and retain existing ones by offering a wider range of products.

Alcohol Manufacturing and Distribution

Image by Dean Moriarty

Distilleries and breweries that produce and distribute alcoholic beverages are subject to Special Occupational Taxation. SOT grants these businesses the privilege of manufacturing and dealing in regulated alcohol products.

Case Study

- Entity: Acme Distillery

- SOT Type: Class 1 Distillery

- SOT Activities: Production and distribution of distilled spirits

Benefits

- Acme Distillery is authorized to produce and distribute distilled spirits legally, which would otherwise be prohibited.

- SOT status demonstrates compliance with federal alcohol laws and regulations.

- Acme Distillery can attract new customers and retain existing ones by offering a variety of distilled spirits.

Tobacco Retailers

Image by jan mesaros

Tobacco retailers must obtain a SOT to legally sell certain tobacco products, such as cigars and other tobacco items subject to federal taxation. SOT status ensures compliance with applicable regulations and taxation requirements.

Case Study

- Entity: Smoke Shop

- SOT Type: Class 2 Tobacco Retailer

- SOT Activities: Sale of cigars and other tobacco products subject to federal taxation

Benefits

- Smoke Shop is authorized to sell certain tobacco products legally, which would otherwise be prohibited.

- SOT status demonstrates compliance with federal tobacco laws and regulations.

- Smoke Shop can attract new customers and retain existing ones by offering a variety of tobacco products.

Importers and Exporters

Image by Robert Wilkos

Entities that import or export goods subject to specific federal regulations may require SOT status. This includes items falling under the purview of the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF).

Case Study

- Entity: Global Trading Company

- SOT Type: Importer/Exporter of Firearms

- SOT Activities: Import and export of firearms and other regulated items

Benefits

- Global Trading Company is authorized to import and export firearms and other regulated items legally, which would otherwise be prohibited.

- SOT status demonstrates compliance with federal laws and regulations governing the import and export of regulated items.

- Global Trading Company can expand its business reach and capitalize on new opportunities in global markets. For example, the importation of Italian firearms can bring a higher profit for Global Trading Company.

Professional Service Providers

In some instances, individuals providing professional services, such as consultants or advisors specializing in firearms compliance, may also be subject to SOT requirements. This underscores that SOT is not limited to tangible goods but can extend to services within industries requiring specialized knowledge and expertise.

Case Study

- Entity: Firearms Compliance Consulting

- SOT Type: Class 3 SOT

- SOT Activities: Provision of firearms compliance consulting services.

Benefits

- Firearms Compliance Consulting is authorized to provide firearms compliance consulting services legally, which would otherwise be prohibited.

- SOT status demonstrates expertise and proficiency in firearms compliance laws and regulations.

These case studies showcase the versatility of SOT status across various sectors, emphasizing its role in ensuring compliance, regulating specific industries, and facilitating legal transactions. As businesses navigate the complexities of their respective fields, SOT emerges as a critical component of the regulatory landscape, contributing to the broader framework of federal oversight and taxation.

The Bottom Line

Our exploration of Special Occupational Taxpayer (SOT) has revealed a complex and multifaceted landscape. By understanding its historical foundations, various classifications, application procedures, and associated rights and responsibilities, we can gain a deeper appreciation for this crucial designation.

From its legislative origins to the critical eligibility criteria, SOT is known for its complex processes and requirements. By delving into the benefits and potential challenges, we can paint a comprehensive picture of what it means to hold SOT status, shedding light on the privileges and restrictions that accompany this designation.

This article serves as a starting point for your journey to comprehend the intricacies of SOT. To deepen your understanding, I encourage you to explore recent developments, seek real-world examples, and stay informed about any legislative changes. For those contemplating SOT application, follow the outlined steps diligently. Existing SOT holders must stay vigilant in meeting compliance requirements.