How to Obtain an FFL and SOT Status: Navigating NFA Firearm Regulations

Posted by Mandu Moses on Dec 22nd 2023

If you are interested in buying, selling, or making NFA firearms, such as silencers, machine guns, short-barreled rifles and shotguns, and destructive devices, you might have come across the term "Class 3 Firearms License."

This term is, however, a common misconception. There is no such thing as a Class 3 License for personal use or possession of NFA firearms. What you actually need is a Federal Firearms License (FFL) and a Special Occupational Taxpayer (SOT) status.

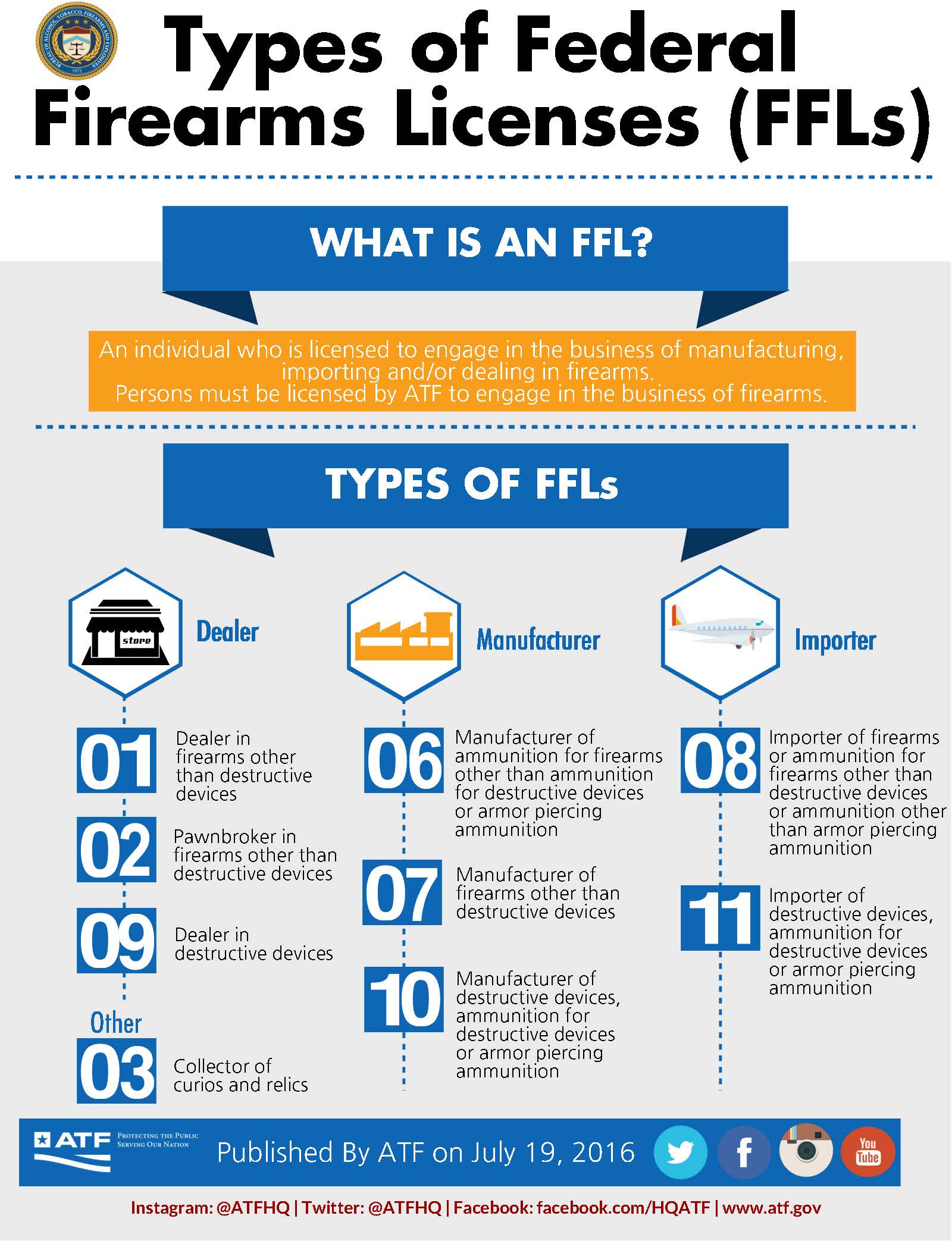

What is an FFL?

An FFL is a license issued by the Bureau of Alcohol, Tobacco, Firearms, and Explosives (ATF) that allows individuals and businesses to engage in the regulated business of dealing with firearms. The types of FFLs vary depending on the nature and scope of your firearm-related activities. For instance:

- A Type 01 FFL is for gun dealers.

- A Type 02 FFL is for pawnbrokers.

- A Type 07 FFL is for manufacturers of firearms, and there are many more categories to suit specific business needs.

Image Courtesy: atf.gov

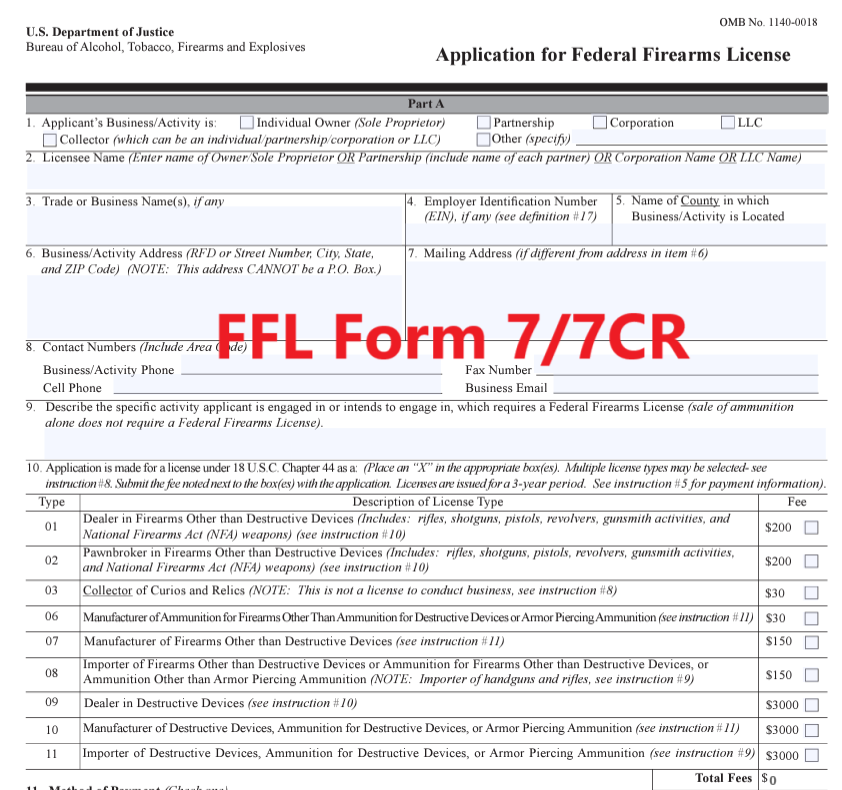

How To Apply for an FFL

To apply for an FFL, you must meet certain eligibility criteria, which include:

- Being at least 21 years old.

- Having secure business premises.

- Complying with state and local laws.

- Passing a background check.

Steps

- Complete the ATF Form 7/7CR application

- Pay an application fee (ranging from $30 to $3000, depending on the type of FFL).

- Submit your application to the ATF.

The ATF will then assign an Industry Operations Investigator (IOI) to conduct an in-person interview and inspect your business premises. This comprehensive process may take up to 60 days from the receipt of a properly completed application.

Read a detailed application process from this manual: How to Get a Federal Firearms License: An Overview

What Is An SOT?

An SOT is a special tax status that allows an FFL holder to deal in NFA firearms without paying the transfer or making tax for each item. NFA firearms are regulated by the National Firearms Act (NFA) of 1934, which imposes a $200 tax on the making or transferring of most NFA firearms, except for Any Other Weapons (AOWs), which have a $5 tax. NFA firearms include silencers, machine guns, short-barreled rifles and shotguns, destructive devices, and AOWs.

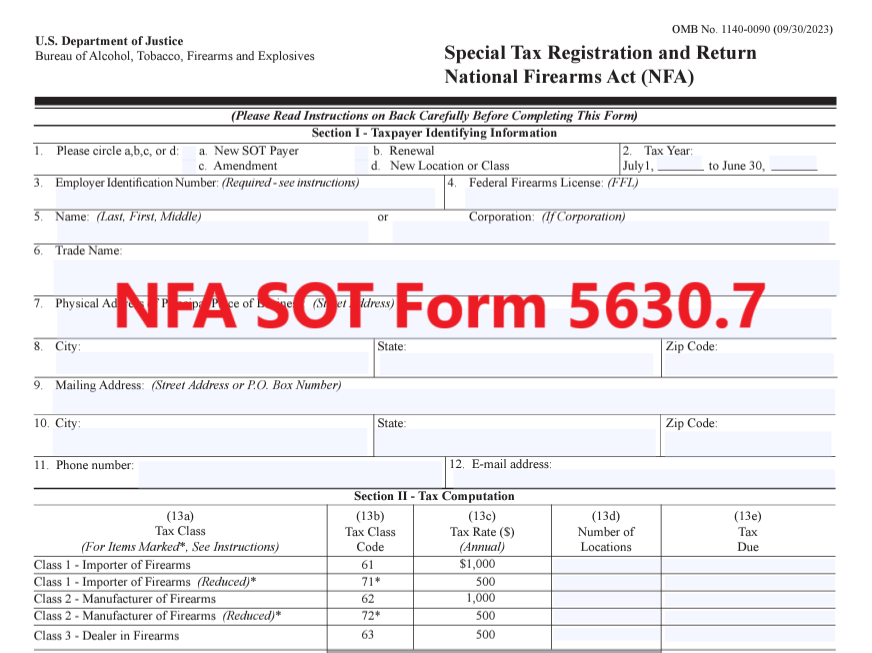

How To Become An SOT

To become an SOT, you need to have a valid FFL and pay an annual tax based on your FFL type:

- If you have a Type 01 or 02 FFL, you need to pay $500 per year to become a Class 3 SOT.

- If you have a Type 07 or 10 FFL, you need to pay $1000 per year to become a Class 2 SOT.

A Class 3 SOT can buy and sell NFA firearms to other SOTs or non-SOTs (with proper paperwork and tax). A Class 2 SOT can also make NFA firearms for sale or research purposes.

How To Apply for an SOT Status

- To apply for an SOT status;

- Complete the ATF Form 5630.7 application

- Pay the tax (by check, credit card, or money order)

- Submit it to the ATF.

You can apply for an SOT status anytime during the year, but the tax year runs from July 1 to June 30. Therefore, if you apply after July 1, you will have to pay the full amount of tax for the current year. If you apply before July 1, you will pay a prorated amount for the remaining months of the current year.

Here’s everything you need to know about Special Occupational Taxpayer (SOT) status: Everything You Need to Know About Special Occupational Taxpayer

Benefits Of Having an FFL And SOT Status

Obtaining an FFL and SOT status provides numerous advantages:

- You can legally buy, sell, or make NFA firearms without paying the transfer or making tax for each item.

- You gain access to a broader market of customers and suppliers interested in NFA firearms.

- Your NFA paperwork enjoys faster processing times, as the ATF prioritizes applications from SOTs over non-SOTs.

Obligations for FFL and SOT Status Holders

These benefits come with responsibilities and obligations:

- Maintain accurate records of your inventory and NFA firearm transactions.

- Comply with federal, state, and local laws and regulations regarding firearms.

- Renew your FFL and SOT status annually by paying the required fees and taxes.

- Cooperate with ATF inspections and audits of your business premises and records.

Conclusion

The term "Class 3 Firearms License" is not a correct term. It is a common misconception to refer to an FFL holder with a Class 3 SOT status. To obtain a Class 3 SOT status, you need a valid FFL (such as a Type 01 or 02) and pay an annual tax of $500 to the ATF.

This status allows you to buy and sell NFA firearms without paying the transfer or making tax for each item. However, you must also adhere to the rules and regulations governing FFLs and SOTs, such as record-keeping, license and tax renewal, and legal compliance.